1)What is a mutual fund?

MUTUAL FUND: A mutual fund is a professionally managed investment vehicle that pools money from multiple investors to buy securities like stocks, bonds, or other assets. It’s ideal for individuals wanting diversification and expert management without picking stocks.

2)What are the types of mutual funds?

They are classified on different aspects as follows:

Based on Structure

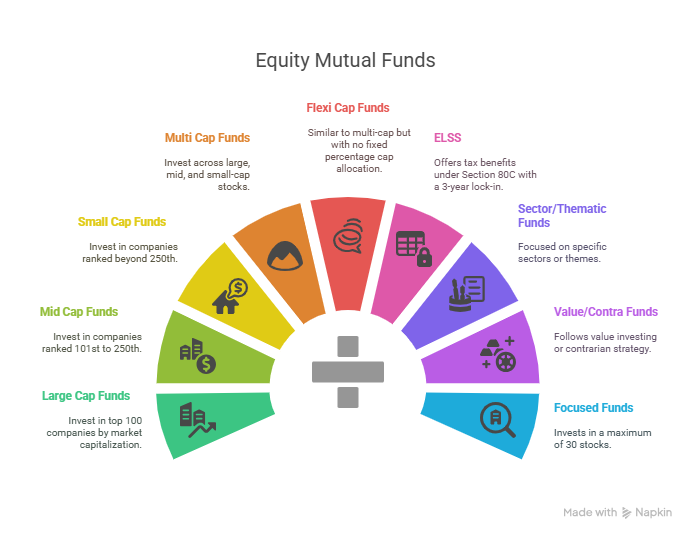

a. Equity Mutual Funds

- Definition: Invest at least 65% of their assets in equity and equity-related instruments.

- Risk Level: High

- Returns: Potential for high long-term capital appreciation

- Types:

- Large Cap Fund: Invests in the top 100 companies by market capitalization.

- Mid Cap Fund: Invests in 101st–250th ranked companies.

- Small Cap Fund: Beyond the 250th-ranked companies.

- Multi-Cap Fund: Invests across large, mid, and small-cap stocks.

- Flexi Cap Fund: Similar to multi-cap but with no fixed percentage cap allocation.

- ELSS (Equity Linked Savings Scheme): Offers tax benefits under Section 80C, has a 3-year lock-in.

- Sector/Thematic Fund: Focused on specific sectors (like Pharma, IT) or themes (like ESG).

- Value/Contra Fund: Follows value investing or contrarian strategy.

- Focused Fund: Invests in a maximum of 30 stocks.

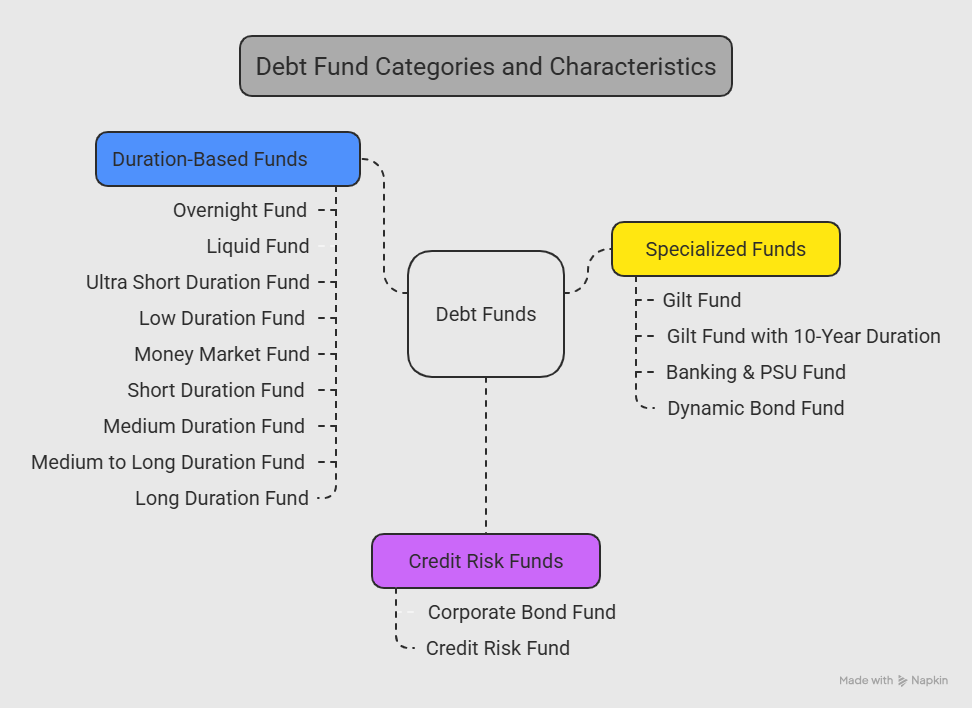

b. Debt Mutual Funds

- Definition: Invest primarily in fixed income securities like bonds, treasury bills, government securities, and commercial papers.

- Risk Level: Low to moderate (interest rate and credit risk)

- Returns: More stable, but lower than equities

- Types (as defined by SEBI):

- Overnight Fund: Investment in 1-day maturity instruments.

- Liquid Fund: Maturity up to 91 days, ideal for parking idle money.

- Ultra Short Duration Fund: Duration of 3–6 months.

- Low Duration Fund: 6–12 months.

- Money Market Fund: Maturity up to 1 year.

- Short Duration Fund: Duration of 1–3 years.

- Medium Duration Fund: 3–4 years.

- Medium to Long Duration Fund: 4–7 years.

- Long Duration Fund: More than 7 years.

- Dynamic Bond Fund: Duration changes dynamically based on interest rate views.

- Corporate Bond Fund: At least 80% in AA+ or higher-rated corporate bonds.

- Credit Risk Fund: At least 65% in below-AA-rated bonds—higher risk & potential return.

- Gilt Fund: Invests only in government securities (no credit risk).

- Gilt Fund with 10-Year Duration: Average maturity of around 10 years.

- Banking & PSU Fund: Invests primarily in debt of banks, PSUs, and public financial institutions.

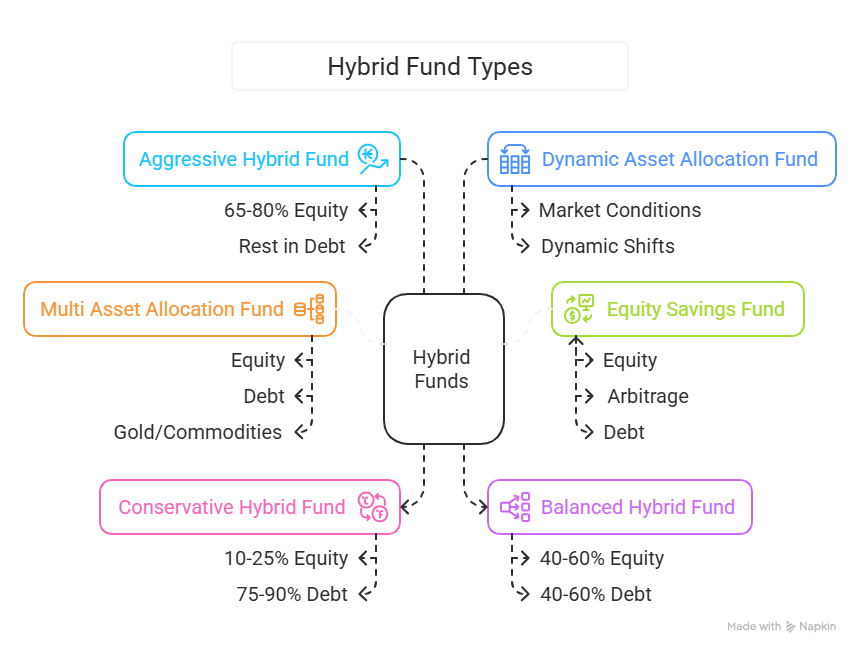

c. Hybrid Mutual Funds

- Definition: Invest in a mix of equity and debt instruments to balance risk and return.

- Types:

- Conservative Hybrid Fund: 10–25% equity & 75–90% debt.

- Balanced Hybrid Fund: 40–60% equity & debt each (no arbitrage).

- Aggressive Hybrid Fund: 65–80% equity, rest in debt.

- Dynamic Asset Allocation (Balanced Advantage Fund): Shifts between equity and debt dynamically based on market conditions.

- Multi Asset Allocation Fund: Invests in at least three asset classes (equity, debt, gold/commodities).

- Equity Savings Fund: Uses equity, arbitrage, and debt strategies—less volatile than pure equity funds.

2. Based on Structure

a. Open-Ended Funds

- Can be bought or redeemed anytime at NAV.

- The most common structure in India.

b. Close-Ended Funds

- Have a fixed maturity period (e.g., 3 or 5 years).

- Can only be bought during NFO (New Fund Offer) and traded on the stock exchange thereafter.

- Example: Fixed Maturity Plans (FMPs)

c. Interval Funds

- Operate as a hybrid between open and closed-ended.

- Allow transactions only during specific intervals (monthly, quarterly, etc.)

3. Based on Risk Profile

- High Risk: Small-cap funds, sector funds, thematic funds, credit risk funds.

- Moderate Risk: Hybrid funds, large & mid-cap equity funds.

- Low Risk: Liquid funds, overnight funds, gilt funds.

4. Other Specialized Types

a. Index Funds

- Passively track an index like the Nifty 50 or Sensex.

- Lower expense ratio compared to actively managed funds.

b. Exchange Traded Funds (ETFs)

- Like index funds but traded on stock exchanges.

- Requires a demat account.

c. Fund of Funds (FoFs)

- Invest in other mutual fund schemes instead of direct securities.

- Example: International FoFs.

d. International Funds

- Invest in global equities or funds.

- Helps in geographical diversification.